Administration Matters

Do I need to register with the IRAS?

Do I need to register with the IRAS?

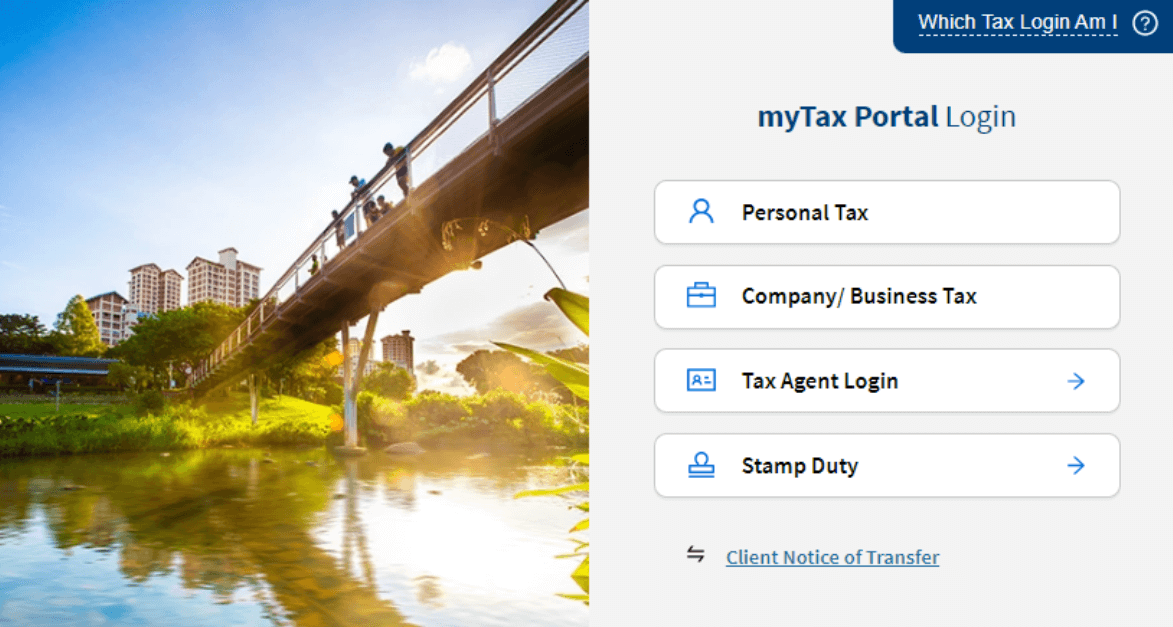

You should not be required to register with the IRAS for tax filing purposes. However, you may wish to register for Singpass (Singpass - Register for Singpass) so that you may be able to transact with the IRAS online, such as updating of address, download copies of tax documents issued to you, etc, via the IRAS myTax Portal (IRAS | myTax Portal).

Annual Tax Return (Form B1) Filing Matters

Do I need to apply for a tax number for Singapore tax filing?

Do I need to apply for a tax number for Singapore tax filing?

Tax reference number is the Singapore NRIC / Foreign Identification Number (FIN) as per the employment pass. No separate application for tax reference number is required.

I received the No Filing Service (NFS) letter from IRAS. Do I still have to file a tax return?

I received the No Filing Service (NFS) letter from IRAS. Do I still have to file a tax return?

If you are authorised for tax services and have received an email from our team informing of the same, please disregard the letter received from the IRAS.

Employer is in the Auto-Inclusion Scheme (AIS) for employment income. Do I still have to file a tax return?

Employer is in the Auto-Inclusion Scheme (AIS) for employment income. Do I still have to file a tax return?

Please note that the employer will only electronically transmit your employment income details to the IRAS via AIS. You are still required to file your Singapore tax return to declare your other chargeable sources of Singapore income and make the relevant relief claims, unless (i) you receive the NFS letter and there are no changes to your auto-included income and previous year’s relief claims OR (ii) Deloitte is assisting you with the tax filing.

When will my tax return be ready?

When will my tax return be ready?

Tax returns will be finalised in batches based on when complete information (for example, tax questionnaire, calendar, compensation information, etc) is provided.

Generally, you should receive the tax return package between mid-March to early-June. An email notification will be sent to you once the package is posted to GlobalAdvantage for your review and approval.

When is my tax return due for filing?

When is my tax return due for filing?

Original deadline: 18 April

Final extended deadline: 30 June (Deloitte will assist to obtain extension from the IRAS)

The IRAS does not impose interest on the tax due for requesting for extension of time to file the return.

What if my tax return is filed after the deadline?

What if my tax return is filed after the deadline?

The IRAS may impose penalty for late filing of tax return.

Tax Clearance Return (Form IR21) Filing Matters

What happens when I cease employment in Singapore?

What happens when I cease employment in Singapore?

When you cease employment in Singapore, and where you are a non-Singapore citizen, non-SPR or SPR employee ceasing employment and leaving Singapore permanently (including an SPR who will be on overseas assignment for a period of 3 months or more), your employer is required to file a tax clearance return (i.e., Form IR21) to report your remuneration (including gains from actual exercise or “deemed exercise” of stock options granted during the Singapore employment) up to the date of cessation of employment at least one month before the expected date of cessation of employment or departure from Singapore, whichever is earlier.

In addition, your employer is required to withhold any monies due and payable to you until the tax clearance is obtained from the IRAS or the expiry of 30 days from the receipt of the Form IR21 by the IRAS. Most Forms IR21 are processed within 21 days but processing time may take longer if the information given in the Form IR21 is incomplete or where the IRAS needs to seek clarification on the information submitted. Any GIRO instalment that you may have in place will also be cancelled and all outstanding tax liability will be payable immediately.

Tax clearance and the withholding of monies is not applicable to Singapore citizen employees ceasing employment in Singapore. Singapore citizen employees can also continue to settle their taxes via monthly GIRO instalments, if in place, even if they are working outside of Singapore.

Tax Notice and Payment Matters

Which address should I use on the IRAS tax documents?

Which address should I use on the IRAS tax documents?

This may be your residential or office address in Singapore.

If you are a foreign employee who has just arrived in Singapore, the address in the IRAS’ initial record should typically be the address that was used in the application of your Singapore employment pass.

How do I update my contact details and notification preferences with the IRAS?

How do I update my contact details and notification preferences with the IRAS?

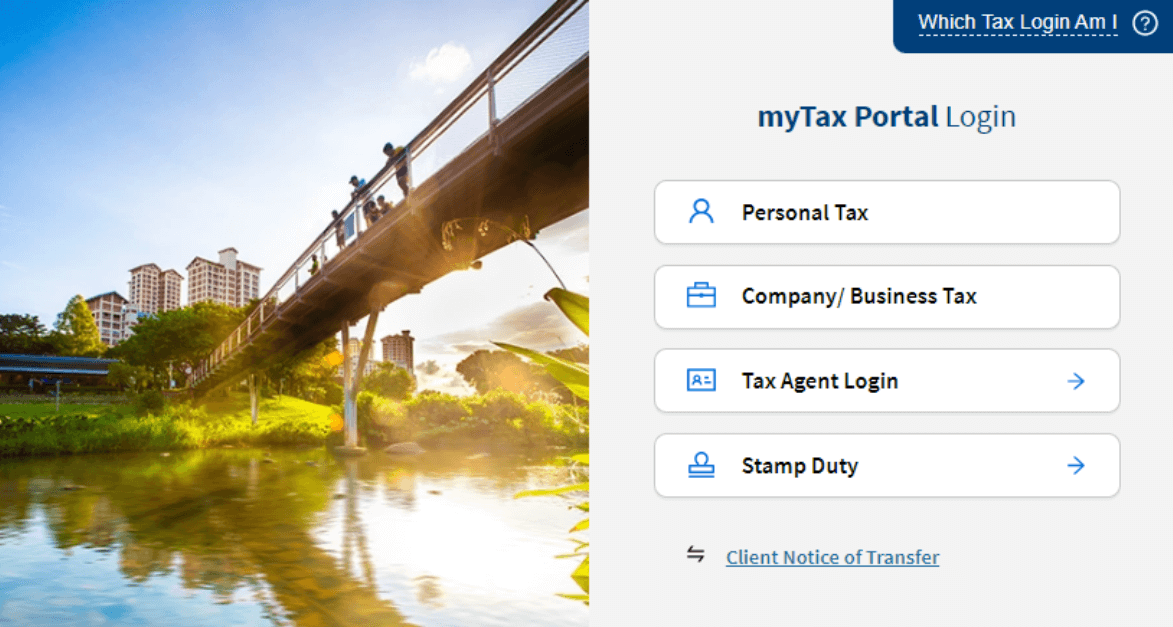

Log in to myTax Portal using your Singpass (select “Personal Tax”).

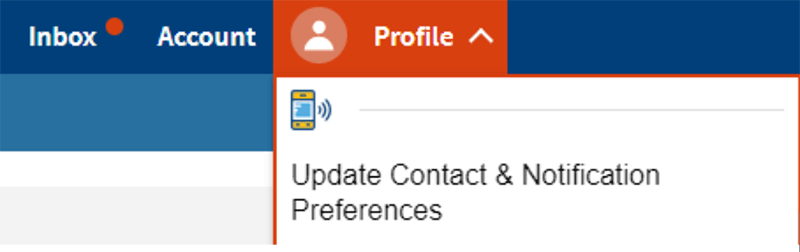

Go to “Profile” at the top navigation panel > Update Contact & Notification Preferences.

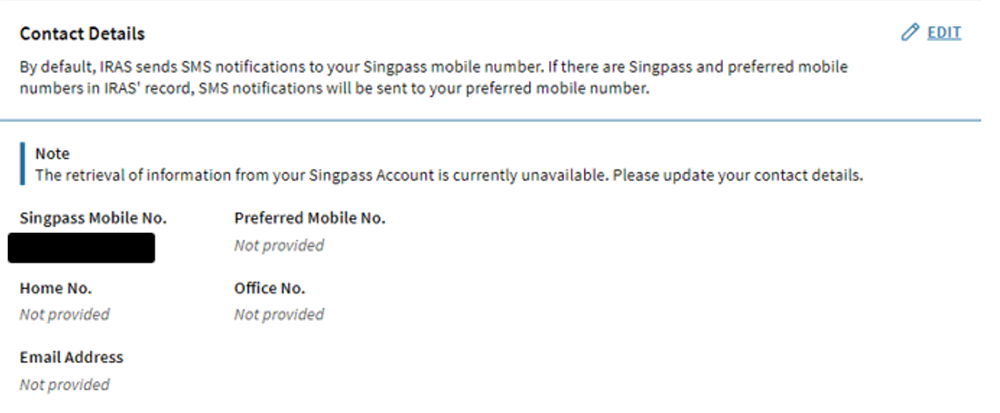

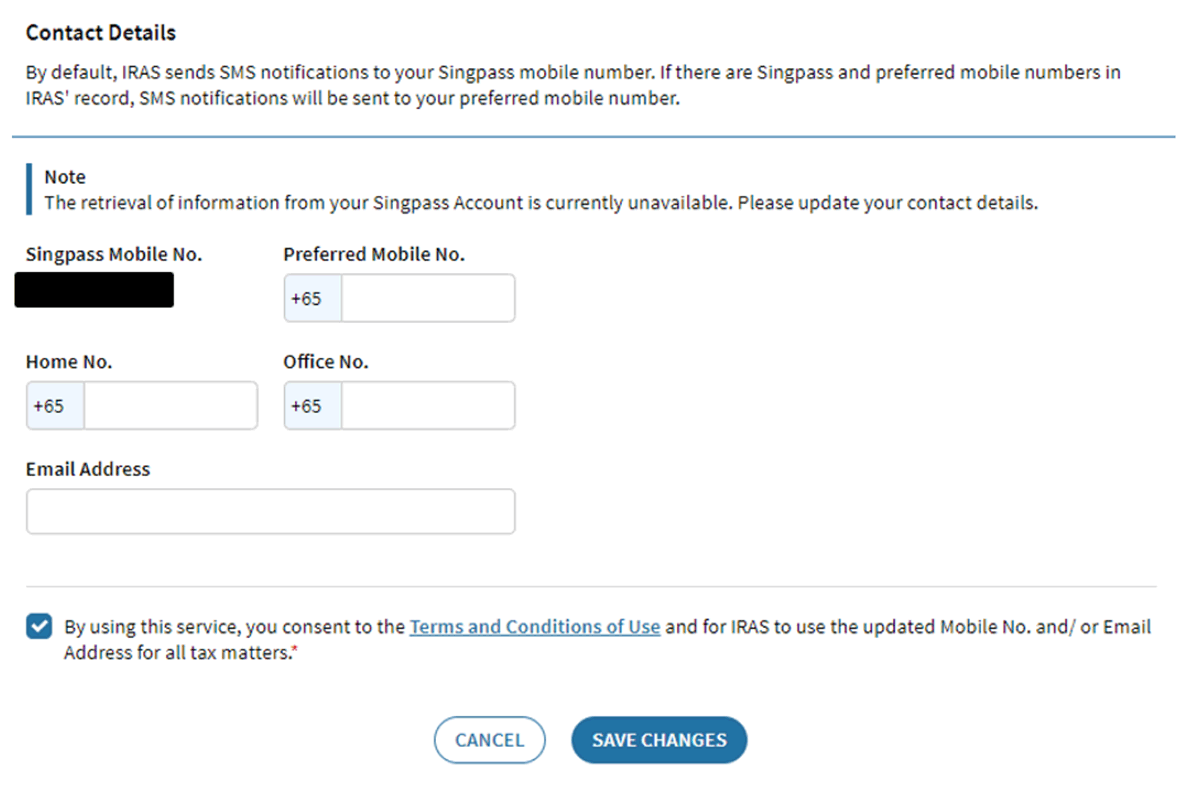

To update contact details

You will see your contact details per IRAS’ records. If you would like to make changes, click “Edit”.

Make the necessary changes and click “Save Changes”.

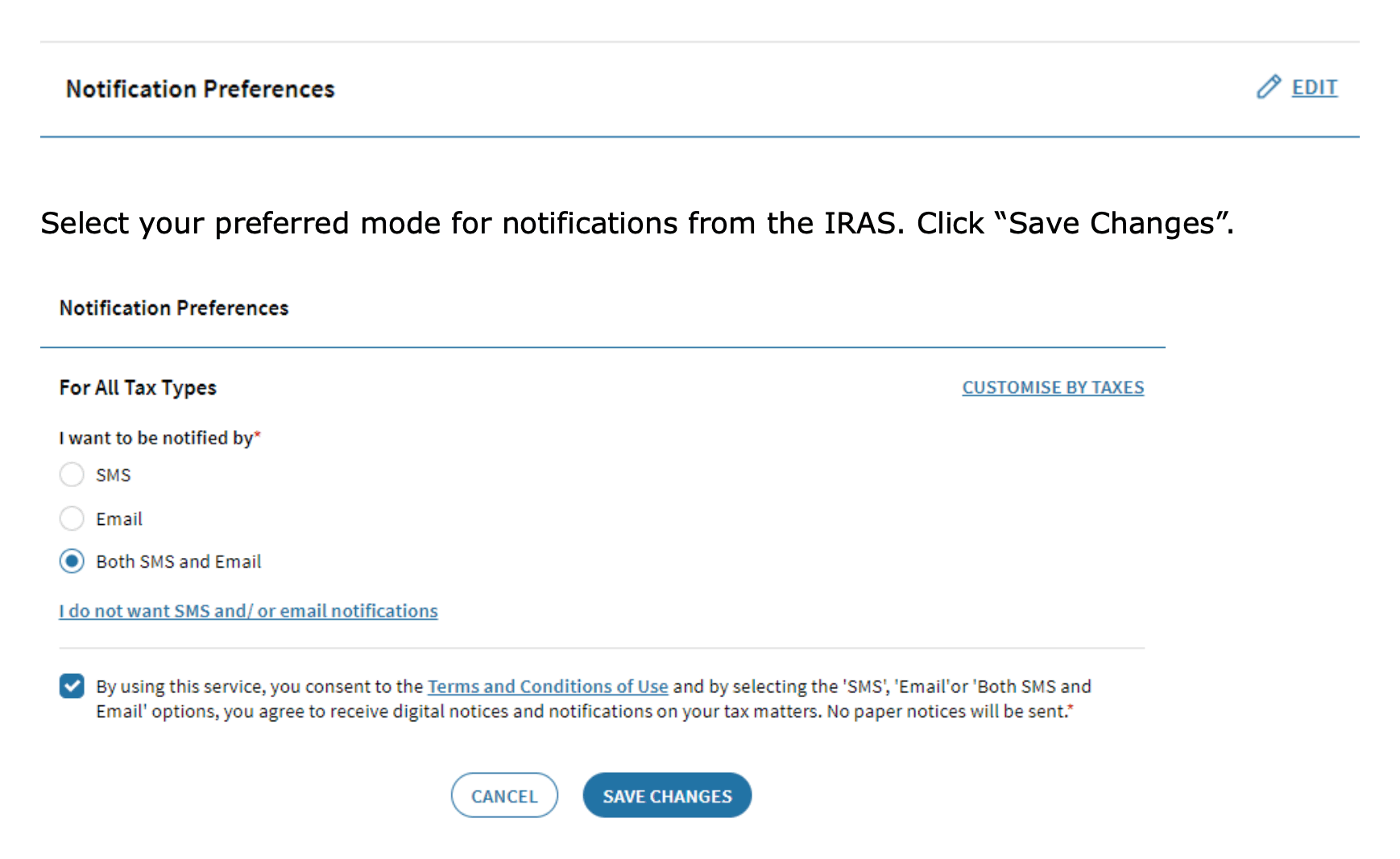

To update notification preferences

Under the section for notification preferences, click “Edit”.

Select your preferred mode for notifications from the IRAS. Click “Save Changes”.

Important: By selecting any of the notification preference options, you will only receive digital tax notices and the IRAS will not send paper tax notices to your mailing address.

When will I receive my tax notice, i.e., Notice of Assessment (NOA)?

When will I receive my tax notice, i.e., Notice of Assessment (NOA)?

The IRAS will typically issue the Notice of Assessment (NOA) within 1 to 2 months after your tax return is submitted, although it may take longer in some cases and the NOA may sometimes only be issued in November/December.

Most tax notices are digitised and the paper NOA will be phased out. To receive SMS/email notifications when the NOA is ready for viewing on myTax Portal (IRAS | myTax Portal), please update your contact details (mobile phone number and/or email address) with the IRAS.

Once your NOA is available, please download a copy from myTax Portal and forward the same to your Deloitte Singapore representatives for verification and payment advice as the settlement of tax is time sensitive. Please note that the IRAS will not issue the NOA to your tax agent (Deloitte) but directly to you (the taxpayer).

Important note on electronic notices:

If you have subscribed to e-Notices, the IRAS will not be mailing the paper NOA to you.

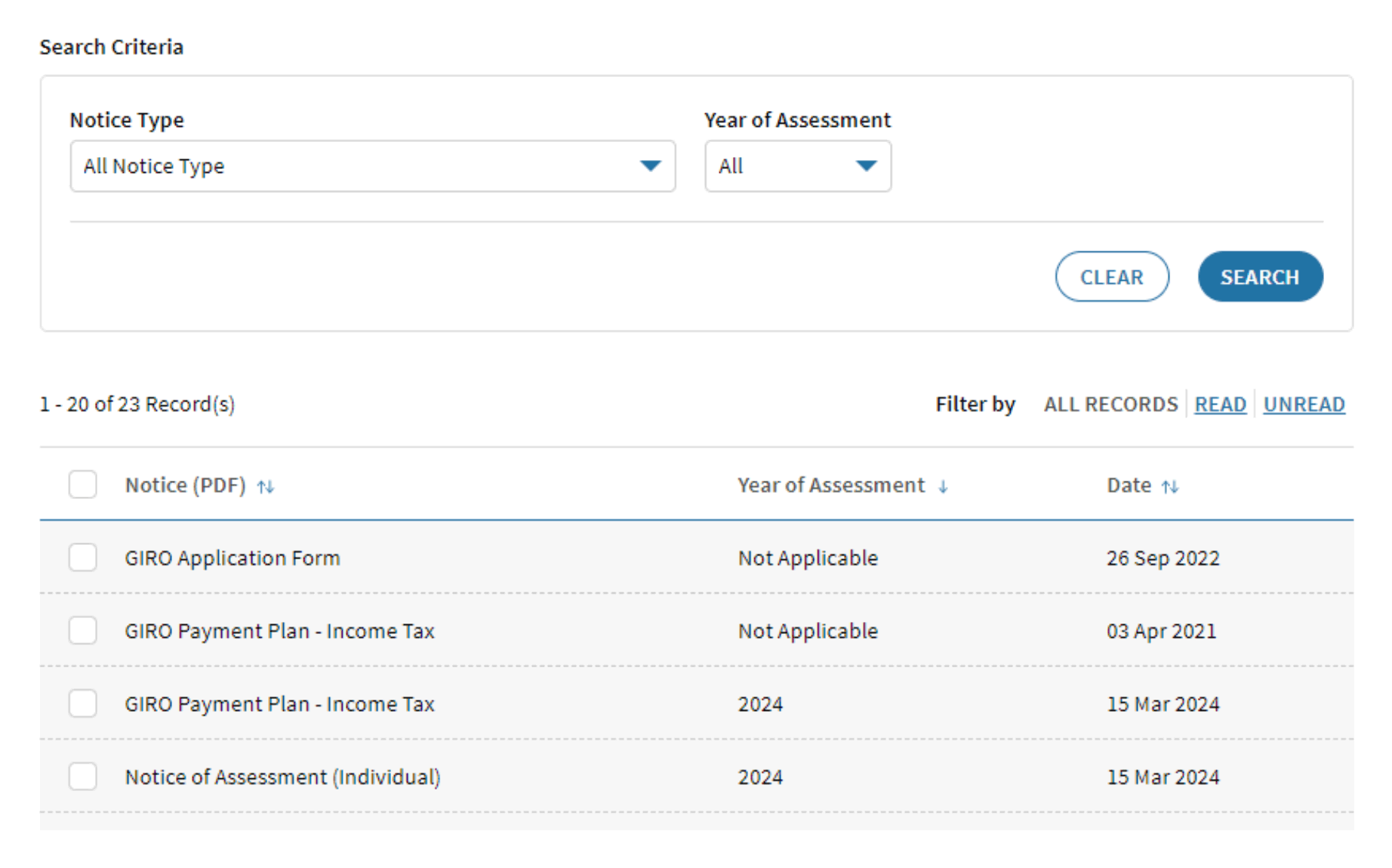

How do I retrieve my NOA and tax documents from the IRAS Portal?

How do I retrieve my NOA and tax documents from the IRAS Portal?

Log in to myTax Portal using your Singpass (select “Personal Tax”).

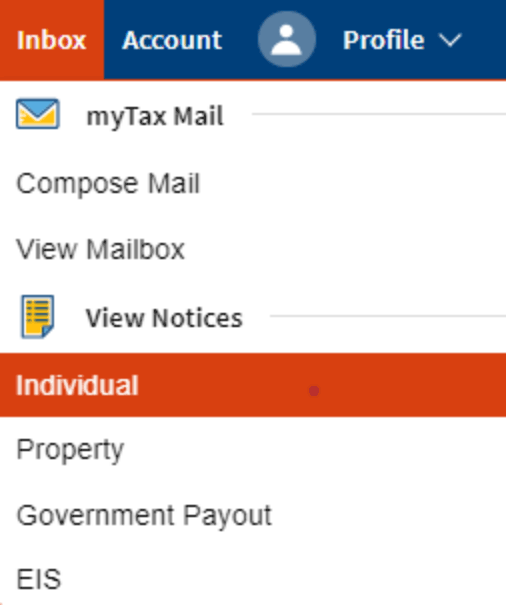

Once you have logged in, go to “Inbox”. Under the “View Notices section > click “Individual”.

You will see the list of tax notices/documents that can be downloaded. Do note that you will only be able to view records for the current year and the past 3 years.

I am worried that I may miss my NOA or payment deadline. What can I do?

I am worried that I may miss my NOA or payment deadline. What can I do?

You can register your mobile number and/or email address with the IRAS so that the IRAS would send SMS and/or email notifications on your tax matters.

Important: Beware of scams or phishing attempts! There will not be any clickable links in IRAS’ notifications and the IRAS will not send tax documents to taxpayers via email.

What is the due date for making tax payment?

What is the due date for making tax payment?

The tax payment of income tax is due within 1 month from the date of NOA, unless you have arranged to pay by GIRO instalments.

For tax clearance, tax is generally required to be settled immediately upon the issue of the NOA. Where monies have been withheld by the employer, the IRAS will issue a directive to the employer to settle the taxes from the monies withheld. Any excess monies that may have been withheld from you will be refunded to you once the taxes are settled. Where the monies withheld are insufficient, please arrange for payment of the balance tax to the IRAS directly.

How do I pay my income tax?

How do I pay my income tax?

Various options are available, and you may visit the IRAS website for more information: (IRAS | Payments).

I do not have sufficient cash to pay my income tax in one lump sum. What can I do?

I do not have sufficient cash to pay my income tax in one lump sum. What can I do?

You may apply for GIRO and pay your income tax by interest-free instalments. Deductions will be made automatically from your designated bank account based on the GIRO instalment plan issued by the IRAS.

For more information on GIRO, please visit the IRAS’ website: GIRO (Individual Income Tax)

Important note for non-Singapore citizen taxpayers:

The GIRO instalment plan will be cancelled once your employer submits the tax clearance return (Form IR21) to the IRAS when you cease employment in Singapore. Any outstanding taxes will be payable immediately once the Directive to Pay Tax is issued.

What if I pay my income tax late?

What if I pay my income tax late?

The IRAS will impose late payment penalty of 5%. Additional 1% penalty may be imposed for each month that the income tax remains outstanding (maximum additional penalty is capped at 12%).

In addition, the IRAS may take the following enforcement actions:

- Issue travel restriction to the Immigration and Checkpoints Authority (ICA) of Singapore to prevent you from leaving the country.

- Appoint your bank, employer or tenant of your property in Singapore as agent to withhold any monies due to you and pay to the IRAS.

Does the IRAS issue receipt for tax payment?

Does the IRAS issue receipt for tax payment?

No, the IRAS does not issue receipt for income tax payment.

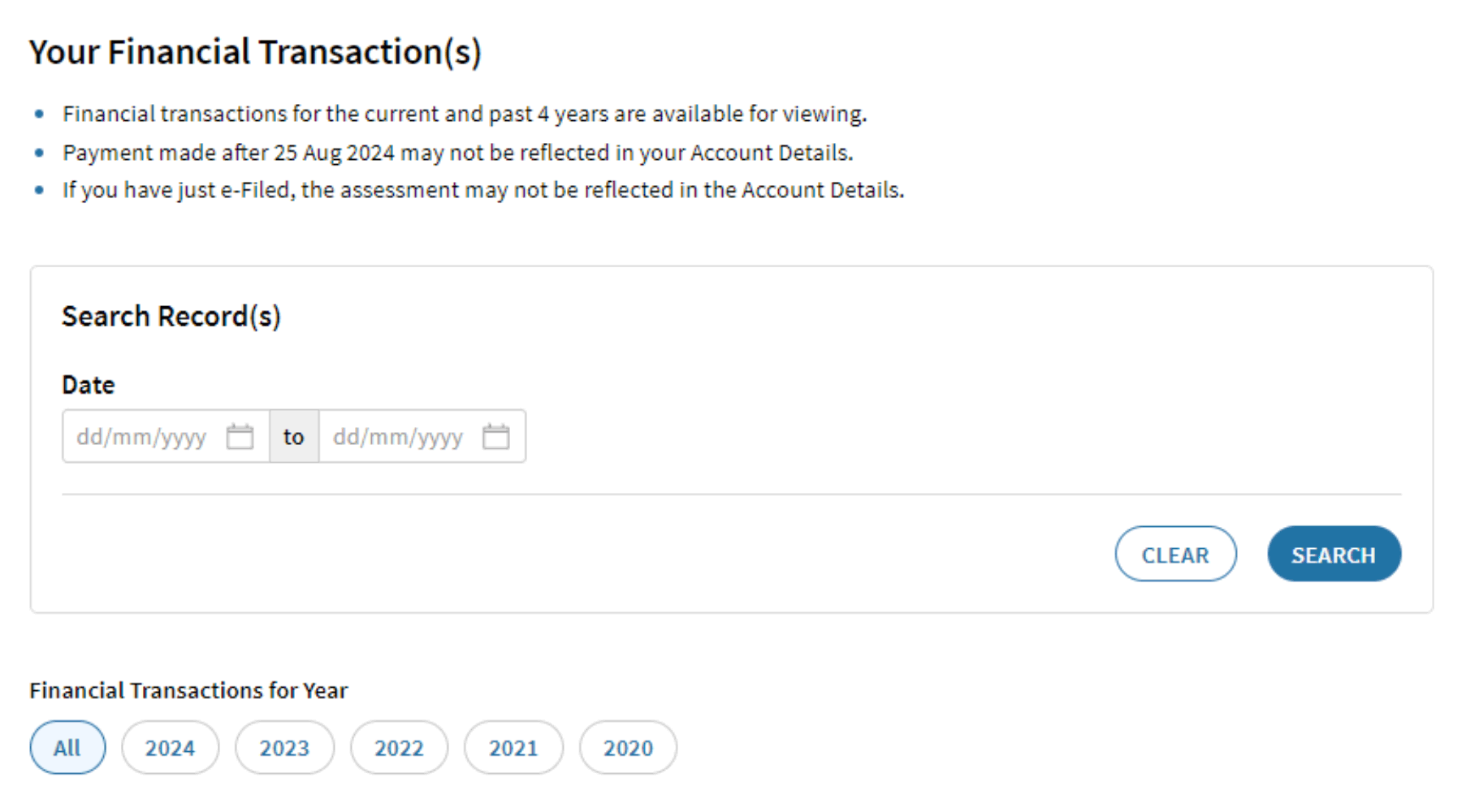

You may view your income tax account balance via myTax Portal under the “Individual Income Tax” section. Click “View Account Details” > “View Details” and you will see the transactions (e.g., tax payment, tax assessment, penalties, etc.) for the current and the past 4 years.

What if I do not agree with the NOA?

What if I do not agree with the NOA?

If you disagree with the tax assessed in your NOA, you must lodge a written objection with the IRAS within 30 days from the date of the NOA and state the reasons for your objection. You may lodge an objection via Inbox of the IRAS portal under “myTax Mail” where you may compose the mail. The IRAS will inform you of the outcome accordingly after the review of the objection.

Notwithstanding any objection lodged, please note that any tax payable will still have to be settled within the stipulated deadline as indicated in the NOA unless a request for an extension of the payment deadline has been granted by the IRAS.

Contacts

Who should I contact if I have questions in relation to the briefing?

Who should I contact if I have questions in relation to the briefing?

If you have further questions, please do not hesitate to contact the Deloitte Singapore representatives.

Please note, that depending on the nature of your query, we may need to obtain approval in advance from your employer if further advice or detailed guidance is needed.